Automating your savings and investments is a practical way to build financial security without constantly thinking about it. Setting up automatic transfers helps remove the hassle of manual management and reduces the chance you’ll skip contributions when life gets busy. Over time, this steady approach turns small amounts into lasting growth by taking advantage of compound interest and disciplined habit.

When you automate your savings and investments, you make your money work in the background while you focus on daily life. This method keeps decision fatigue at bay and helps maintain consistent progress toward your financial goals. By making steady contributions automatic, you can grow your wealth steadily without the stress of remembering or deciding when to move money around.

Understanding the Benefits of Automating Your Finances

Automating your savings and investments takes the effort out of managing money regularly. When you set things up to happen on their own, you avoid common pitfalls like skipping contributions or feeling overwhelmed by financial choices. This structured approach doesn’t just simplify your routine—it encourages steady progress toward your financial goals without constant reminders or stress.

Beyond convenience, automation helps you build a strong financial foundation by turning saving and investing into habits that grow quietly in the background. Let’s explore how this process reduces decision fatigue, builds consistency, and also takes advantage of employer benefits and tax savings.

Reducing Decision Fatigue and Building Consistency

Saving and investing can seem like a series of constant choices: How much to save this month? Which fund to invest in? Should I skip this contribution because of unexpected expenses?

Automating these steps clears out that clutter. When your dollars move automatically at regular intervals, the need to make repeated financial decisions dissolves. This not only saves mental energy but also helps you build a consistent saving habit that many people struggle with.

Imagine your automatic savings like a slow and steady river, inching forward day by day. Instead of relying on willpower or memory, your finances advance naturally through scheduled transfers. This rhythm is crucial because consistent contributions take advantage of compound interest, which is one of the most effective ways to grow wealth over time.

Some key points about how automation builds consistency:

- You avoid the temptation to spend money earmarked for savings.

- Regular contributions eliminate the “start tomorrow” delay.

- It removes emotional stress tied to timing the market or saving “just the right amount.”

By simply deciding once to automate, you let your financial goals move forward with confidence and regularity that manual efforts rarely maintain.

Maximizing Employer Benefits and Tax Savings

Automatic savings can unlock benefits that you might overlook if you’re managing money manually especially when it comes to employer-sponsored retirement plans like a 401(k).

Many employers offer a matching contribution when you save a portion of your paycheck. This match is essentially free money added to your retirement savings, but only if you contribute enough to get the full match. Automating contributions ensures you never miss out on this boost because your contributions happen without fail.

Here’s why automating your retirement contributions is smart:

- Capture the full employer match effortlessly, increasing your savings immediately.

- Reduce your taxable income by contributing pre-tax dollars to plans like a traditional 401(k), lowering taxes today.

- Some plans offer automatic escalation, increasing your contribution percentage year by year. This helps you save more without noticing the extra deduction.

Automating also protects you from forgetting to adjust contributions or missing out during busy periods. The tax advantages combined with employer matches mean your money not only grows faster but also arrives at retirement with less tax drag and more backing from your company.

If you’re wondering how to get started, setting up payroll deduction for your retirement account is usually a simple step through your HR or benefits portal. Once it’s set, your finances keep moving forward on autopilot, tapping into every advantage your employer plan provides.

Automating your finances does more than just save time it builds strong habits and captures benefits that might otherwise slip through the cracks. By removing the friction around saving and investing, you pave a smoother path toward financial growth.

Step-by-Step Guide to Setting Up Automated Savings and Investments

Automating your savings and investments means setting up a system that moves your money regularly without you having to lift a finger. By doing this, you eliminate the hassle of remembering to save or invest, and you keep your financial goals on track with consistent contributions. The process may seem technical at first, but it’s straightforward once you know the steps. Here’s a clear guide to help you automate your money flow efficiently, covering everything from linking your bank accounts to picking the right investment platforms.

Linking Checking and Savings Accounts for Automatic Transfers

The first step is to connect your checking account to a savings account or investment platform so money can move automatically on a schedule that suits you. Most banks make this easy and secure through their online or mobile banking services. Here’s how you can set it up:

- Log in to your bank’s online portal or app.

- Locate the option to add or link an external account (this might be called “transfer,” “linked accounts,” or “external accounts”).

- Enter the routing number and account number of your savings account or investment account you want to transfer money to.

- Complete the verification process. This usually involves confirming small trial deposits your bank makes to the other account. This step proves you actually own both accounts and keeps transfers secure.

- Once linked, set up automatic transfers. Choose an amount to transfer and a schedule — weekly, biweekly, or monthly works best for syncing with paychecks.

- Confirm and save your settings.

The benefits of linking your bank accounts this way include:

- No accidental missed transfers because it all happens automatically.

- Strong security layers protect your information with encryption and verification steps.

- Flexibility to modify or pause transfers anytime you want directly from your banking app.

This setup makes saving money feel as effortless as setting a coffee machine timer in the morning. It quietly builds your savings, so you don’t have to think about it.

Enrolling in Employer-Sponsored Retirement Plans

If your job offers a retirement plan like a 401(k) or Roth IRA, setting up automatic payroll deductions is one of the simplest ways to grow your nest egg steadily. Here’s what to do:

- Contact your HR or benefits department. This can usually be done online via your employer’s benefits portal.

- Decide how much you want to contribute from each paycheck. A good rule of thumb is aiming for at least enough to get any employer match — that’s free money you don’t want to leave on the table.

- Select your retirement account type (401(k), Roth 401(k), or other options), and specify the contribution percentage or dollar amount.

- Select investments within your plan. Many plans have target-date funds or diversified portfolios designed to suit different risk levels and time horizons.

- Submit your enrollment and verify your paycheck deductions have started.

Starting early is key because the sooner you contribute, the longer your money has to grow through compound interest. Automating your contributions means you pay yourself first automatically, helping you build long-term wealth without relying on willpower or manual effort.

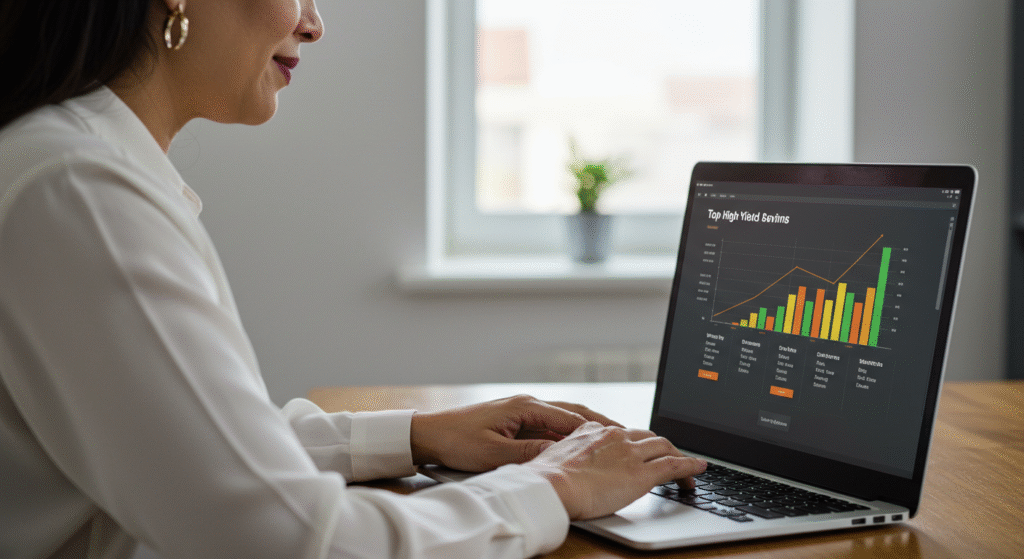

Choosing the Right Investment Platforms and Accounts

Once your savings are set to grow automatically, you can move a step further by automating investments through user-friendly platforms. Robo-advisors and investment apps make this process accessible and manageable:

- Robo-advisors like Betterment, Wealthfront, or Fidelity’s automated services create a diversified portfolio for you based on your risk tolerance and goals. They handle things like portfolio rebalancing and dividend reinvestments.

- Investment apps such as Acorns or Stash round up your everyday purchases to the nearest dollar and invest the spare change automatically, building your portfolio gradually.

- You can link your bank accounts directly to these platforms for seamless transfers every week or month.

Automated investing platforms typically offer:

- Portfolio rebalancing, which means your investments stay aligned with your risk preferences without you needing to intervene.

- Customizable risk levels so you can start conservatively or be more aggressive based on your comfort.

- Low or no minimums, making it easy for beginners to get going without large upfront sums.

By choosing the right automated investing solution, you set your money to work steadily, ensuring your portfolio adapts as markets change while you stay hands-off.

Automating your savings and investments is like setting a strong foundation for your financial house. Linking your accounts securely, enrolling in workplace plans, and selecting effective investment platforms can make the process smooth and dependable. Once set up, you watch your financial goals grow quietly in the background while you focus on what matters most in life.

Top Tools and Apps to Automate Savings and Investments

When automating your savings and investments, the right apps and tools can make the process truly effortless. They work behind the scenes, ensuring you save consistently, invest wisely, and spot new opportunities without lifting a finger. I’ve found that using apps tailored for different parts of the automation journey brings the best results—from tiny automatic savings to fully managed investment portfolios. Here’s a closer look at some of the most effective apps available today.

Micro-Investing and Round-Up Apps

Apps like Acorns excel at turning everyday spending into savings and investments. The core idea is simple: they round up your purchases to the nearest dollar and automatically invest the spare change. It’s a way to save small amounts that add up over time, without changing your daily habits or feeling the pinch.

Here’s why I recommend micro-investing apps for beginners and busy savers:

- Automatic spare change investing: Every purchase you make rounds up, and the leftover pennies go straight into diversified portfolios.

- Low minimums: You don’t need a big lump sum to start investing; these apps make it easy to begin with just a few dollars.

- Set-it-and-forget-it: Once linked to your spending accounts, savings happen quietly, with no extra steps from you.

- Educational tools: Many apps provide simple insights about your investments to help you grow your financial knowledge.

Acorns, in particular, combines rounding up with recurring deposits, offering a one-two punch that consistently grows your portfolio. Over time, these small deposits ride the ups and downs of the market, building wealth gradually without the usual barriers to entry.

Robo-Advisors for Hands-Off Investing

For those wanting a more structured and professional investment approach with minimal involvement, robo-advisors like Wealthfront and Betterment deliver. These platforms evaluate your financial goals, income, risk tolerance, and timeline before automatically building and adjusting your portfolio.

What makes robo-advisors particularly appealing:

- Personalized portfolio management: Algorithms build a diversified portfolio tailored to your profile.

- Automatic rebalancing: Your asset allocation is adjusted regularly to maintain a risk level you choose.

- Tax efficiency: Many robo-advisors use strategies such as tax-loss harvesting to lower your tax obligations.

- Low fees: Compared to traditional financial advisors, robo-advisors offer affordable management fees.

- Easy access and updates: You can monitor progress, update goals, or change preferences anytime on mobile apps.

I trust robo-advisors because they take emotional decision-making out of the equation. Instead of guessing when to buy or sell, the app keeps your investments aligned with your plan, making hands-off investing genuinely hands-off.

AI-Powered Budgeting and Savings Apps

Artificial intelligence has redefined what budgeting and savings apps can do. Apps like Cleo and Rocket Money use AI to analyze your spending patterns and find hidden ways to save. They identify redundant subscriptions, suggest where you can cut costs, and even recommend the optimal amounts and timing for transferring money into savings.

Some standout features of AI savings apps:

- Subscription management: AI spots and cancels subscriptions you no longer use, often saving you dozens of dollars each month.

- Smart saving nudges: They suggest amounts you can save safely, based on your income and spending habits.

- Expense categorization: AI accurately tracks where your money goes, giving you clearer insights and helping to optimize your budget.

- Conversational interfaces: Apps like Cleo interact via chatbots, making financial management feel more personal and less like a chore.

Using AI-powered apps means your finances get smarter on their own. Rather than just tracking numbers, these apps actively look for savings opportunities and help you make better financial choices every day.

Combining tools that automate micro-investing, robo-advisors that manage portfolios, and AI apps optimizing budgets creates a powerhouse setup. This way, your money grows steadily with minimal effort, while you stay informed and in control. Automating your savings and investments with these tools is the easiest way to build wealth over time without the usual stress or complexity.

Maintaining and Adjusting Your Automated Financial Plan

Setting up an automated system for saving and investing is just the beginning. Like any plan that involves your money and life goals, it needs regular attention to perform at its best. Your finances, income, and goals will shift over time, and your automation should follow suit. Maintaining and adjusting your automated financial plan ensures you stay on track and make the most of your efforts without missing opportunities or taking on unnecessary risks.

Here’s how I recommend managing your plan over time to keep your automated savings and investments aligned with your changing life and income.

Scheduling Regular Financial Checkups

Automating your transfers and investments doesn’t mean you can forget about them entirely. Setting a recurring schedule to review your finances helps you catch problems early and tweak your plan when needed. These checkups can be monthly, quarterly, or whatever fits your rhythm. What matters is the habit of regularly confirming that transfers happened as expected and your investments are performing according to your goals.

I keep a simple checklist when I do my financial reviews, which includes:

- Confirming automatic savings and investment transfers posted successfully.

- Comparing investment returns against benchmarks or expectations.

- Checking if any fees have changed or unexpected charges appeared.

- Reviewing recent spending to see if any cash flow adjustments are needed.

Monthly or quarterly reviews don’t take much time but empower you to stay in control. They prevent small errors from compounding and allow you to adjust before slips widen. It’s like tuning a machine periodically rather than waiting for a breakdown.

Adjusting Contributions Based on Income Changes

Life throws curveballs—raises, job changes, unexpected expenses, or new debts can impact your financial capacity. Automated plans that stay rigid during these shifts risk either overcommitting and bouncing checks or under-saving and missing your goals. The smart move is to adjust the amounts you save and invest whenever your income or expenses change significantly.

When your income increases, consider:

- Boosting your automatic contributions to accelerate your progress.

- Prioritizing high-impact savings like retirement accounts or emergency funds.

- Using employer-matched accounts to the maximum extent.

If expenses rise or income shrinks, you might:

- Temporarily reduce your savings contributions to maintain cash flow.

- Postpone less urgent financial goals if needed.

- Revisit your budget for areas to free up savings potential.

The key is to tweak your automation deliberately, reflecting your current financial situation instead of sticking blindly to fixed amounts. Many platforms let you easily adjust transfer amounts online. I recommend aligning your contribution adjustments with your paydays or financial checkups, making them part of a natural financial routine.

Incorporating New Financial Goals into Automation

Financial goals are not set in stone. Major milestones like buying a home, starting a family, education expenses, or preparing for emergencies—require new savings buckets or reallocation of funds. Automation makes it easy to add or modify these goals without forgetting to save for them.

Here’s how you can incorporate new goals into your automated system:

- Create separate savings accounts or sub-accounts dedicated to each new goal.

- Set up automatic transfers with specific amounts or percentages aligned to these goals.

- Use tools or apps that allow goal tracking and notify you about progress.

- Adjust existing contributions to release funds for higher priority goals if necessary.

By automating new goals, your plan remains flexible yet disciplined. It mimics how a well-managed garden needs occasional pruning and new plants to thrive through changing seasons. This ensures you never lose momentum toward your bigger dreams even as life evolves.

Maintaining your automated financial plan is an ongoing process. Scheduling regular checkups, adapting contributions to income changes, and weaving in new goals keeps your savings and investments responsive to your life. This way, automation stays more than just a set-it-and-forget-it tool—it becomes a living system that grows with you.

Conclusion

Automating your savings and investments builds a solid foundation for steady financial growth while cutting down stress and guesswork. By setting up simple, regular transfers, you create a reliable habit that steadily grows your money, tapping into benefits like compound interest and employer matches without extra effort.

Starting small and staying consistent is all you need to unlock long-term progress. Over time, these automated actions combine to create real financial stability and help you reach goals that might otherwise seem overwhelming.

Take control today by setting up your automation system. It’s the easiest way to make steady progress while freeing your mind for the things that matter most. Your future self will thank you for making saving and investing a seamless part of your routine.