Most of us have felt the monthly money squeeze, where buying groceries, paying bills, and trying to save can feel like a juggling act. It’s easy to lose track of where your cash goes, leading to unwanted surprises at the end of the month. Creating a simple monthly budget is the first smart move toward turning that chaos into calm.

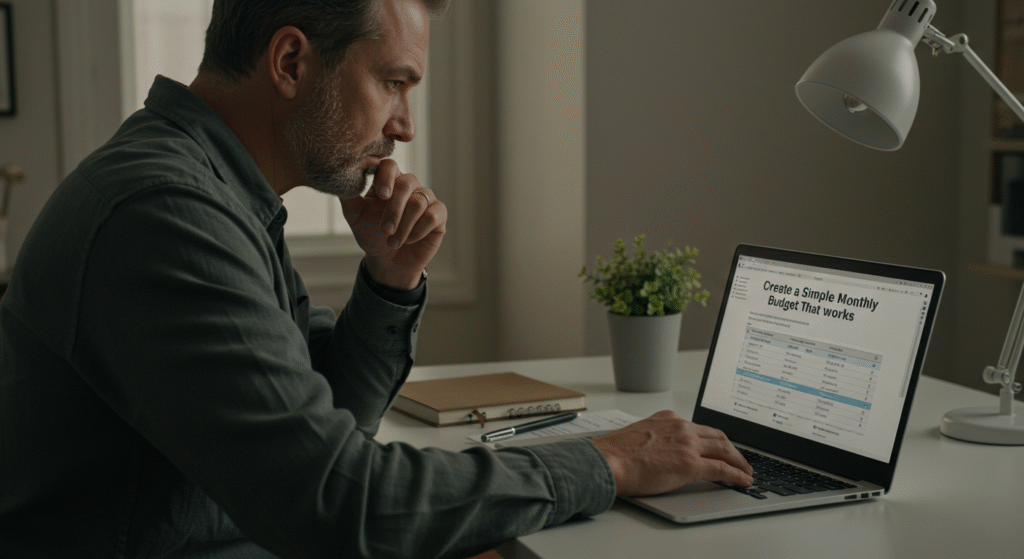

A good budget brings real control, helping you see exactly where your money comes from and where it goes. It’s not about strict rules, but giving yourself a plan that brings peace of mind. In this guide, I’ll walk you through how to create a simple monthly budget that works in real life, so you can finally experience financial clarity and less stress all with steps you can start today.

Getting Clear on Your Money In and Out

Building a monthly budget that works starts with seeing your money as it truly moves. This means knowing both how much comes in and how much goes out nothing left fuzzy or hidden in small print. When you have a clear picture of your cash flow, you’re not stuck living in the dark or haunted by surprise expenses. This clarity is the foundation for strong money decisions and long-term peace of mind.

Listing All Sources of Income

Before you map out spending, you need to count every dollar coming in. People often overlook sources other than their main paycheck, making their budget less accurate. Take time to list all your regular and side income, such as:

- Full-time and part-time job salaries (post-tax)

- Freelance gigs or side hustles

- Rental earnings, child support, or alimony

- Government benefits or student aid

- Investment income, dividends, or occasional cash gifts

A clean list will keep your calculations honest. For those paid irregularly, it’s smart to average your last three to six months of actual take-home pay. Digital budget apps or simple spreadsheets help keep these numbers visible and verifiable. Seeing your “real” monthly income arms you with the confidence to set achievable goals that fit your financial reality.

Tracking Regular and Irregular Expenses

Tracking expenses is about more than watching big-ticket items. The coffee runs, parking fees, and online subscriptions quietly drain your wallet too. I break expenses into two clear buckets:

- Fixed expenses: Rent, mortgage, car payments, insurance, utilities. These show up reliably each month.

- Variable expenses: Groceries, eating out, hobbies, ride shares, pet care. These swing up and down.

To track effectively:

- List all fixed expenses first. These form your base spending.

- Review at least two months of bank and credit card statements. Highlight every purchase—no exception.

- Capture irregular or annual costs. Some bills, like insurance premiums or car registrations, come only once or twice a year. Divide those totals by 12 and add that amount to your monthly budget.

Many find that using a free app or an automated tool can save a ton of time. These platforms can connect to your accounts, sort your transactions by categories, and quickly flag trends you might miss. The important thing is not what you spend, but that you track it honestly and completely.

Spotting Patterns and Pitfalls in Spending

Once your income and expenses are out in the open, real insights begin to emerge. Patterns can reveal silent budget killers and sometimes surprising opportunities for savings. I like to step back each month and look for these telltale signs:

- Regular overspending in certain categories like dining out or online shopping

- Forgotten subscriptions or recurring charges you don’t use

- A rising trend in impulse purchases when tired or stressed

- Bills paid late, leading to annoying fees and interest

Ask yourself: Where do I feel regret after spending? Where do I consistently run out of money before the month ends? Answering these helps put your finger on what needs addressing first.

Quick Tips to Catch Patterns:

- Color-code your expenses by category for easy visual clues

- Watch for “surprise” expenses that keep returning

- Compare this month’s variable spending to last month’s totals

By spotting and understanding your spending habits, you can reroute money towards goals that matter whether that’s building savings, paying down debt, or simply breathing easier by month’s end. Getting clear on your numbers gives you control, not just hope.

Building a Budget That Matches Real Life

A simple monthly budget that works isn’t about putting yourself in a money straitjacket. Real life is full of changes, surprises, and yes, the occasional splurge. The real win is a plan that fits your habits, needs, and goals now not just numbers on a spreadsheet. I think about budgeting like building a house: you need the right blueprint, solid materials, and room to grow. When your budget actually reflects your real spending and priorities, it stops being a headache and becomes a practical tool you can trust.

Choosing a Simple Budgeting Method

Picking a budgeting method is all about what actually works with your personality and routine. There’s no one-size-fits-all, but some methods are time-tested for a reason:

- 50/30/20 Rule: Spend 50% of your income on needs, 30% on wants, and 20% on savings or debt payments. This flexible structure keeps your priorities straight while letting you breathe.

- Zero-Based Budgeting: Here, every dollar has a purpose. You start with your income, assign every cent to a category, and end up with zero left over. This approach is great if your income shifts month to month.

- Envelope System: Go old-school and divide cash into envelopes for set categories like groceries, gas, and dining out. When the envelope’s empty, you’re done spending.

- Budgeting Apps: Modern apps track spending and alert you when you’re close to your limit. If you like getting notifications and easy charts, this can keep you engaged and accountable.

Most people feel more confident with a mix. For example, 53% track expenses manually for control, while 21% rely on apps for speed and convenience. What matters is choosing a system that makes it easy for you to follow your money in real time. If one method stresses you out, try another until it feels natural.

Setting Needs, Wants, and Savings Priorities

Your monthly budget needs to reflect your actual life not an ideal version. Dividing spending into needs, wants, and savings is the clearest way to do that.

- Needs: These are essentials: housing, utilities, basic food, insurance, transportation, and minimum loan payments. They keep your life running.

- Wants: Think streaming services, eating out, entertainment, travel, upgraded tech, and extras for hobbies. Enjoy these, just don’t let them overrun essentials.

- Savings and Debt Repayment: Treat saving like a must-have, not a nice-to-have. That means setting aside money each month for an emergency fund, future big purchases, or paying down high-interest debt.

A smart budget gives every category its right spot. I always put my needs on auto-pay, automate savings transfers as soon as my paycheck lands, and let the rest go toward wants. If I overspend on wants one month, I’ll adjust the next. Balancing these buckets is key too little saved or too much spent on wants will kick you off your path fast.

Common mistakes to watch for:

- Ignoring savings and treating it as whatever’s “left over”

- Underestimating costs for needs and overestimating how much you have for wants

- Letting irregular or annual bills catch you off guard

Prioritize by listing your top three savings goals and the three biggest spending leaks. This quick check helps you stay honest and shift money to what really matters.

Making Room for Every Expense, Big or Small

A simple monthly budget that works must account for every expense fixed and variable, large or tiny. It’s often the little things that sneak up and ruin your plan.

Include these every month:

- Fixed expenses: Rent, mortgage, car payment, insurance premiums, childcare.

- Variable expenses: Groceries, gas, medical co-pays, dining out, clothes, utilities (which can change seasonally).

- Irregular or annual expenses: Car registration, holiday gifts, annual subscriptions, dental checkups, or vet bills.

Ignore nothing. Start by going through two or three recent bank statements and highlighting anything that isn’t totally predictable. Divide those totals by twelve and stash that amount each month in a separate “sinking fund” savings pot.

Practical tips to plug budget leaks:

- Use your smartphone’s notes app to log daily purchases for a week

- Set calendar reminders for annual bills

- Review subscriptions every quarter—cancel what you don’t use

- Add a $50 monthly buffer category for surprises (better to have money left over than scrambling)

A common mistake is thinking you can remember everything in your head. Real life doesn’t work that way; small recurring costs can snowball. By planning for both expected and unexpected expenses, your budget becomes a true snapshot of your real world, keeping your financial house solid no matter what pops up.

Quick Comparison Table of Budgeting Methods

| Method | Best For | Key Features |

|---|---|---|

| 50/30/20 Rule | Beginners, steady income | Simple, flexible ratios |

| Zero-Based Budget | Irregular income, detail-oriented | Every dollar assigned |

| Envelope System | Cash spenders, visual learners | Tangible control |

| Budgeting Apps | Tech-savvy, busy schedules | Automation, real-time data |

Choosing the right budgeting plans, setting real priorities, and capturing every cost is how I turn planning into peace of mind each month. Keep your system simple, allow for life’s curveballs, and your budget will finally start working for you, not against you.

Keeping Your Budget Working for You

Setting up a budget is just the beginning. The real challenge is keeping it practical, flexible, and easy enough to stick with every month. Your budget should serve as a tool that adjusts with your life, not a burden that drains your energy. To keep your budget working effectively, it’s essential to lean on the right tools, automate where you can, and revisit your plan regularly. These steps help you spend less time stressing over numbers and more time making progress toward your goals.

Using Tools and Apps to Make Budgeting Easy

Budgeting doesn’t have to mean endless spreadsheets or complicated math. Today’s apps can simplify tracking your income and expenses while giving you instant insights on your progress. Some of the top apps in 2025 include:

- YNAB (You Need A Budget): Ideal for hands-on users who want to assign every dollar a role in their budget. It supports the zero-based budgeting approach and encourages careful planning.

- Goodbudget: Great for beginners or those who like the envelope system. It’s easy to use and focuses on sharing budgets across households but requires manual transaction input.

- Wallet by BudgetBakers: Automatically categorizes spending and highlights recurring bills, perfect for spotting patterns and planning ahead.

- EveryDollar: Combines simplicity with automation, letting you quickly allocate funds and track spending.

Using these tools can save time by connecting directly to your bank or allowing you to enter transactions on the go. They offer visual reports and can send alerts before you overspend in specific categories. This kind of immediate feedback keeps your budget honest and helps prevent surprises. If you want to keep things simple, try one app for a month and see how it fits your routine.

Automating and Simplifying Your Savings

Saving consistently feels hard until you make it automatic. The easiest way to keep your budget working is to treat your savings like a fixed expense so the money moves out before you even get a chance to spend it.

Some practical automation strategies include:

- Set up automatic transfers from your checking to a savings account on payday.

- Use apps that round up purchases and save the difference, nudging your savings forward without thinking about it.

- Divide your savings into specific buckets (emergency fund, vacation, future purchases) with separate schedules or amounts set for each.

The benefit? You remove the temptation to skip saving and build your cushion steadily without relying on willpower. If your income fluctuates, set a minimum automatic transfer with the option to increase it when possible. Plus, many banks now offer high-yield savings accounts that pay better interest than regular checking, helping your money grow faster while sitting safely.

The goal is simple: pay yourself first and let automation handle the hard parts. Just be sure to revisit these settings every few months to make sure your saving pace still fits your changing needs.

Reviewing Progress and Adjusting as Needed

No budget is perfect forever. Life changes, bills vary, and sometimes you need to shift priorities. That’s why regular check-ins are key to keeping your monthly budget working for you.

Here’s how I keep mine on track:

- Set a quick monthly review: Spend 10 to 15 minutes reviewing your spending, savings, and goals. Compare actual numbers to your budgeted amounts.

- Look for new patterns: Are you consistently overspending on dining out? Did a subscription renew that you forgot about? Spotting these shows where adjustments help.

- Adjust your budget categories: Shift money between categories if needed. For example, if your utility bills rose, cut back a little on discretionary spending for the month.

- Use your financial tools: Most budgeting apps let you generate reports or get notifications, making it easy to spot trends or changes.

Think of your budget like a garden — it needs occasional pruning and extra attention to thrive. If you ignore it, weeds creep in and growth slows down. Regular review means you’re catching potential problems early and adapting smoothly without stress.

A checklist for effective reviews:

- Confirm all income sources are accounted for.

- Verify all recurring and irregular expenses are updated.

- Update savings goals and check progress.

- Adjust for upcoming one-time expenses or plans.

By staying alert and flexible, your budget becomes a living plan that grows with you, making saving and spending feel organized rather than restrictive.

Keeping your budget working for you is about making it simple, automated, and adaptable. Use the right apps to save time, automate savings so they never get skipped, and check in often to keep everything aligned with your goals. This approach turns budgeting from a monthly chore into an empowering habit you can stick with year-round.

Conclusion

Creating a simple monthly budget that works gives you clarity over your money, turning uncertainty into control. When you see exactly where your income is going and plan for every expense, big or small, peace of mind follows naturally.

Your budget doesn’t have to be perfect from day one, but sticking to a straightforward plan and reviewing it regularly keeps it alive and ready to meet changes in your life. I encourage you to try building your own monthly budget now and revisit it often. It’s the steady practice that transforms budgeting from a task into a powerful habit that supports your financial goals.

Remember, a practical budget puts you in charge of your money, not the other way around. Thanks for reading—please share your budget wins or challenges and follow along for more honest, helpful finance tips.